4 Easy Facts About Feie Calculator Explained

The Facts About Feie Calculator Uncovered

Table of ContentsFeie Calculator Fundamentals ExplainedFeie Calculator - Questions9 Easy Facts About Feie Calculator ExplainedThe Buzz on Feie CalculatorFeie Calculator Things To Know Before You Get ThisOur Feie Calculator IdeasIndicators on Feie Calculator You Need To Know

If he 'd regularly taken a trip, he would instead finish Part III, providing the 12-month duration he satisfied the Physical Presence Test and his travel history. Step 3: Coverage Foreign Revenue (Part IV): Mark made 4,500 per month (54,000 every year).Mark calculates the exchange price (e.g., 1 EUR = 1.10 USD) and converts his income (54,000 1.10 = $59,400). Given that he lived in Germany all year, the percent of time he resided abroad throughout the tax obligation is 100% and he goes into $59,400 as his FEIE. Lastly, Mark reports total earnings on his Form 1040 and gets in the FEIE as a negative amount on time 1, Line 8d, lowering his gross income.

Selecting the FEIE when it's not the finest alternative: The FEIE might not be excellent if you have a high unearned income, gain greater than the exemption limit, or reside in a high-tax country where the Foreign Tax Credit (FTC) might be extra valuable. The Foreign Tax Obligation Credit Report (FTC) is a tax reduction method frequently used in conjunction with the FEIE.

The 2-Minute Rule for Feie Calculator

deportees to counter their U.S. tax obligation financial debt with foreign income tax obligations paid on a dollar-for-dollar decrease basis. This means that in high-tax nations, the FTC can typically eliminate united state tax obligation financial obligation completely. Nevertheless, the FTC has restrictions on eligible taxes and the maximum case amount: Qualified tax obligations: Only earnings tax obligations (or tax obligations instead of revenue taxes) paid to foreign federal governments are eligible.

tax liability on your international revenue. If the foreign taxes you paid surpass this limit, the excess international tax can normally be lugged ahead for approximately ten years or carried back one year (via a changed return). Preserving exact records of international revenue and taxes paid is therefore essential to calculating the correct FTC and keeping tax obligation conformity.

migrants to minimize their tax obligations. If a United state taxpayer has $250,000 in foreign-earned income, they can exclude up to $130,000 using the FEIE (2025 ). The staying $120,000 might then go through tax, however the U.S. taxpayer can possibly use the Foreign Tax obligation Credit report to balance out the taxes paid to the international country.

The Feie Calculator Ideas

He marketed his United state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his better half to help accomplish the Bona Fide Residency Test. Neil directs out that acquiring residential or commercial property abroad can be challenging without very first experiencing the place.

"We'll most definitely be beyond that. Also if we return to the United States for doctor's appointments or business calls, I question we'll invest greater than thirty day in the United States in any provided 12-month duration." Neil stresses the relevance of strict tracking of united state gos to. "It's something that individuals require to be actually thorough regarding," he says, and advises deportees to be mindful of common errors, such as overstaying in the united state

Neil is careful to tension to united state tax authorities that "I'm not carrying out any type of service in Illinois. It's simply a mailing address." Lewis Chessis is a tax obligation advisor on the Harness system with substantial experience aiding U.S. people navigate the often-confusing realm of global tax conformity. One of the most usual false impressions among U.S.

Rumored Buzz on Feie Calculator

tax obligation return. "The Foreign Tax obligation Credit scores enables people click this site working in high-tax nations like the UK to counter their U.S. tax liability by the amount they have actually already paid in tax obligations abroad," claims Lewis. This makes sure that expats are not strained two times on the very same earnings. Nonetheless, those in reduced- or no-tax countries, such as the UAE or Singapore, face added difficulties.

The possibility of lower living costs can be appealing, however it commonly features trade-offs that aren't right away apparent - https://feiecalcu.creator-spring.com/. Housing, as an example, can be extra affordable in some countries, yet this can suggest compromising on framework, safety and security, or accessibility to trustworthy utilities and services. Inexpensive properties could be situated in areas with irregular web, restricted public transport, or undependable healthcare facilitiesfactors that can dramatically influence your everyday life

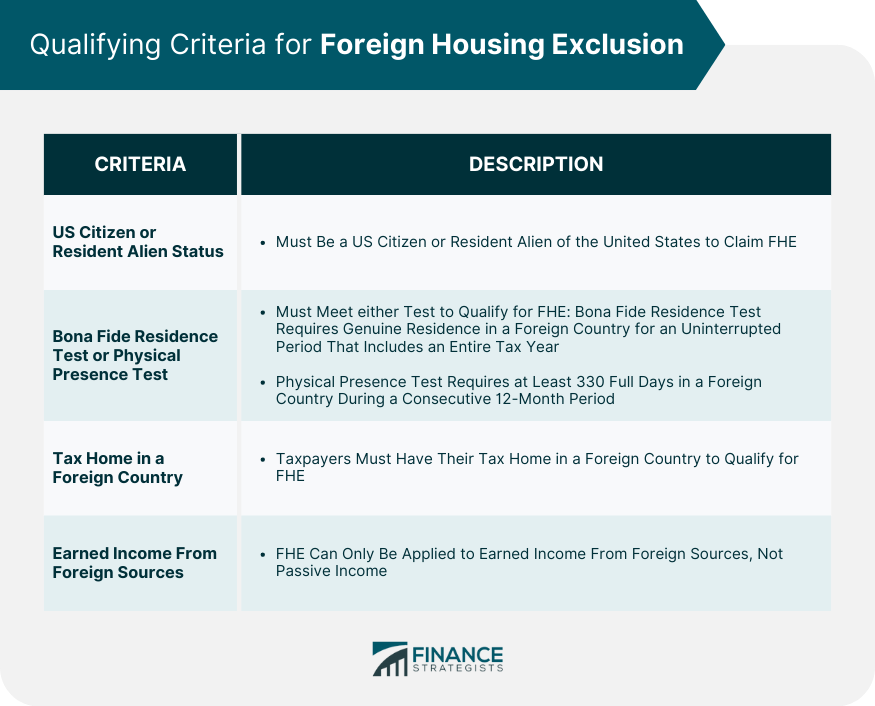

Below are a few of one of the most frequently asked inquiries regarding the FEIE and other exemptions The Foreign Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out as much as $130,000 of foreign-earned earnings from government earnings tax, minimizing their united state tax obligation obligation. To get FEIE, you need to fulfill either the Physical Existence Test (330 days abroad) or the Bona Fide House Examination (verify your primary residence in a foreign country for a whole tax obligation year).

The Physical Existence Examination requires you to be outside the united state for 330 days within a 12-month duration. The Physical Presence Examination additionally requires united state taxpayers to have both an international revenue and a foreign tax obligation home. A tax home is defined as your prime area for organization or work, no matter your family members's house. https://lizard-mechanic-776.notion.site/Foreign-Earned-Income-Exclusion-How-Digital-Nomads-and-American-Expats-Can-Ditch-the-Tax-Burden-240d0ece9741801892a2f0b3d5101c89?source=copy_link.

The 9-Minute Rule for Feie Calculator

An income tax obligation treaty in between the U.S. and an additional country can aid stop double taxation. While the Foreign Earned Income Exemption minimizes taxable revenue, a treaty may provide fringe benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Report) is a required declaring for U.S. citizens with over $10,000 in international financial accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax expert on the Harness system and the founder of The Tax obligation Dude. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxation, cannabis tax and separation associated tax/financial planning issues. He is a deportee based in Mexico.

The international earned income exclusions, often described as the Sec. 911 exemptions, leave out tax obligation on incomes made from functioning abroad. The exemptions make up 2 parts - an earnings exclusion and a housing exemption. The adhering to FAQs review the advantage of the exclusions including when both partners are deportees in a basic way.

The 5-Second Trick For Feie Calculator

The tax advantage excludes the revenue from tax at lower tax obligation prices. Formerly, the exclusions "came off the top" lowering revenue subject to tax at the top tax prices.

These exclusions do not excuse the salaries from US tax but simply provide a tax decrease. Keep in mind that a bachelor functioning abroad for every one of 2025 who gained regarding $145,000 without various other revenue will have taxable earnings lowered to absolutely no - efficiently the same answer as being "free of tax." The exclusions are computed every day.

If you participated in company conferences or seminars in the United States while living abroad, earnings for those days can not be excluded. Your salaries can be paid in the US or abroad. Your company's area or the area where earnings are paid are not variables in certifying for the exemptions. Taxes for American Expats. No. For US tax it does not matter where you maintain your funds - you are taxed on your globally revenue as an US person.